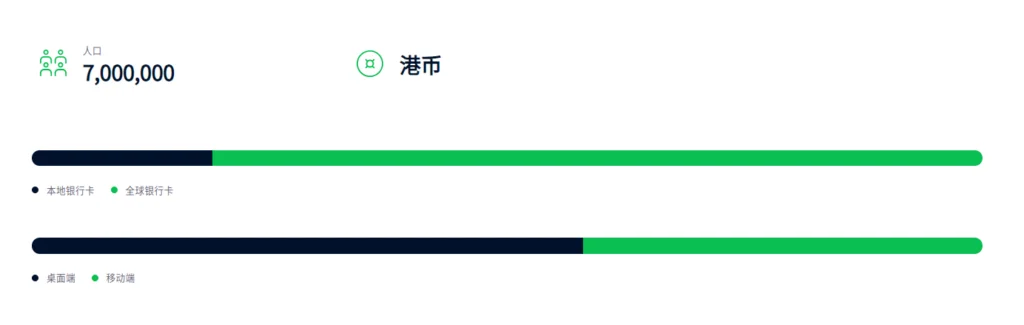

In Hong Kong, digital payments have become an integral part of daily transactions, reflecting the city’s status as a global financial hub. According to the study, 34% of payments were made with credit cards and 38% with prepaid debit cards, with plastic money dominating the payment space. Additionally, 25% of transactions involve mobile wallets, a figure poised to rise with the entrance of major players like Alipay and WeChat Pay into the market. As non-contact and mobile payments gain traction, businesses are increasingly integrating Apple Pay and Google Pay™ into their payment options to cater to evolving consumer preferences.

In the thriving e-commerce market of Hong Kong, credit cards reign supreme as the preferred method for online transactions. According to our recent agility report, 79% of Hong Kong shoppers express a desire for retailers to offer cross-channel payment options, underscoring the importance of convenience and flexibility in the modern retail landscape.

Popular local payment methods include Visa, Mastercard, UnionPay, American Express, Alipay, Apple Pay, and WeChat Pay, reflecting the diverse array of options available to consumers in Hong Kong’s vibrant digital payment ecosystem.

https://www.storeberry.ai/hk/blog/5-electronic-payment-method

1. Credit Card Payments

Credit cards play a significant role in both e-commerce and physical retail transactions in Hong Kong, reflecting the city’s high level of financial sophistication and consumer spending habits.

In Hong Kong’s e-commerce landscape, credit cards are the preferred method of payment for online transactions. The integration of credit card payment gateways into online checkout processes streamlines the purchasing experience, further contributing to their prevalence in the e-commerce sector.

Visa, MasterCard, American Express, and UnionPay are among the most popular credit card networks in Hong Kong. Each network offers distinct features and benefits to cardholders, contributing to their popularity among consumers:

- Visa and MasterCard: Visa and MasterCard are globally recognized payment networks accepted by a vast majority of merchants worldwide. Their widespread acceptance and extensive network of affiliated banks make them preferred choices for both domestic and international transactions. Cardholders benefit from various perks, including travel rewards, purchase protection, and exclusive offers.

- American Express: Known for its premium services and exclusive rewards, American Express caters to affluent consumers and frequent travelers. The brand’s membership rewards program, extensive travel benefits, and customer service excellence distinguish it as a preferred option for high-spending individuals seeking luxury experiences.

- UnionPay: As China’s leading payment network, UnionPay enjoys widespread acceptance in Hong Kong, particularly among mainland Chinese tourists. UnionPay cards offer seamless cross-border transactions and access to a range of benefits tailored to Chinese travelers, such as preferential exchange rates and exclusive discounts.

Merchants must consider transaction fees when accepting credit cards, including interchange, assessment, and processing fees. These fees vary based on factors like card type and transaction volume. For affordable local acquiring rates, explore WooshPay. Click to view pricing.

2. Digital Wallet Payments

Digital wallet payments are rapidly gaining ground in Hong Kong, poised to become the preferred method for online transactions by 2026. While credit cards remain the primary payment method, accounting for 41% of e-commerce transactions and 55% of in-store purchases last year, the trend is shifting towards digital wallets. These wallets are expected to overtake credit cards in online transactions, reflecting a growing preference for convenient and secure payment solutions, with platforms like Alipay Hong Kong (AlipayHK) and WeChat Pay HK leading the charge.

These platforms offer seamless payment experiences and have garnered widespread acceptance across various merchant categories in the city. Notably, they cater to the diverse needs of users, including mainland tourists, by providing convenient payment solutions that are compatible with their preferred payment methods and currencies.For affordable local acquiring rates, explore WooshPay. Click to view pricing.

On the other hand, Apple Pay and Google Pay are gaining popularity due to their robust security features and unparalleled convenience. Both platforms utilize tokenization technology to ensure that sensitive payment information is never shared during transactions, enhancing security and mitigating the risk of fraud. Moreover, the trend towards contactless payments is on the rise, driven by factors such as hygiene concerns and the growing preference for quick and hassle-free transactions. As consumers increasingly embrace contactless payment methods, the adoption of digital wallet platforms like Apple Pay and Google Pay is expected to further accelerate, reshaping the future of payments in Hong Kong.

3. Local Payment Solutions

- Octopus Card (八达通): The Octopus Card has undergone significant digital transformation, allowing its application beyond public transport to daily payments in retail and services. Its widespread use underscores its convenience and efficiency.

- PayMe and PayMe for Business: PayMe offers easy and instant payment solutions suitable for individuals and businesses. PayMe for Business is particularly popular among local merchants due to its straightforward fee structure and ability to facilitate smoother transactions.

4. Faster Payment System (FPS)

- Features and Efficiency: The FPS enhances payment efficiency by allowing instant cross-bank transfers. Its integration into Hong Kong’s payment systems simplifies transactions for both consumers and businesses.

- Convenience and Security: FPS offers high security and convenience, reducing transaction times while ensuring that user data remains protected.

- Bank Services and Fees: Different banks provide varying FPS services, with fees structured to cater to different segments, thereby affecting the overall cost-effectiveness for users.

Wooshpay:A unified payments platform for e-commerce

In summary, WooshPay has significantly impacted the global marketplace payout landscape, offering innovative solutions that simplify cross-border transactions and enhance business efficiency. Numerous eCommerce businesses acclaim WooshPay for its user-friendly interface and the facilitation of secure transactions. Its popularity within the Shopify community is a testament to its effective and secure payment gateway. Moreover, the positive reviews of a considerable number of contented users endorse its success in the industry.

The integration of WooshPay’s cutting-edge payment technology into Xiaomi’s ecosystem will pave the way for effortless cross-border transactions, providing consumers with unparalleled convenience and flexibility. This partnership aligns perfectly with WooshPay’s mission to create a seamless, secure, and efficient global payment experience for both merchants and customers.

As your business reaches out across international borders, the complexities of handling multiple currencies and payment methods can become an overwhelming challenge. Enter WooshPay by SwooshTransfer Ltd, a powerful addition to your Shopify store’s arsenal. Launched recently on May 11, 2023, WooshPay is a free-to-install payment solution designed to conquer the hurdles of cross-border transactions.

WooshPay unites and supports 150 currencies and a variety of payment methods, including credit and debit cards, bank transfers, and e-wallets. In addition, WooshPay offers a comprehensive set of payment services, including dispute services, customizable payment flows, and settlement services.